When it comes to the Proof-of-Stake (PoS) consensus method, the fast blockchain platform Solana has taken the lead. As a result, investors can stake their SOL tokens for rewards while also helping to validate and secure the network. It can be difficult to choose the best staking platform among the many that are accessible.

This article takes a look at the five best Solana staking sites for 2024 and describes them in detail, focusing on the ones that give the highest ROI. Let’s read below about “Best 5 Solana Crypto Staking Platforms with Highest ROI in 2024”.

Staking on Solana: Earning Rewards with High Velocity

When compared to other proof-of-stake platforms, Solana’s blockchain technology has many benefits for staking:

- High Transaction Throughput: Staking on Solana is quick and easy thanks to its high transaction throughput, which can handle thousands of transactions per second.

- Low Fees: Stakeholders are able to maximise their returns thanks to the minimum transaction fees connected with Solana.

- Compounding Rewards: Earnings are automatically added to your staked amount through several Solana staking sites’ compounding rewards, allowing for faster growth over time.

Because of these reasons, Solana has become a popular staking option, drawing an increasing number of platforms that provide attractive payouts and good user experiences.

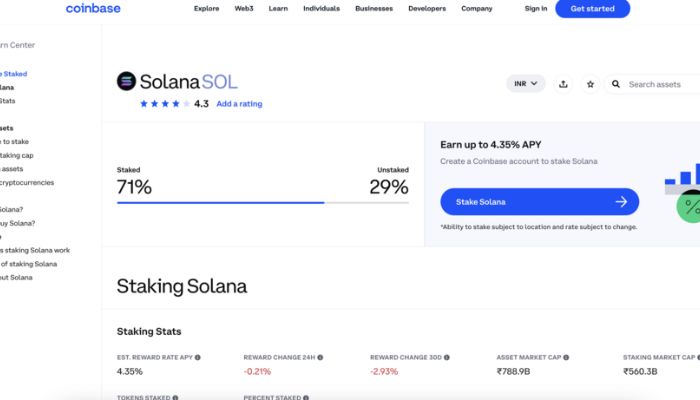

Top 5 Solana Staking Platforms for High ROI in 2024:

Numerous platforms, each with its unique set of advantages and disadvantages, make up the Solana staking environment. The five leading candidates for a high return on investment in 2024 are as follows:

1. Binance: One of the best places to stake SOL tokens is on Binance, a top cryptocurrency exchange. All levels of stakers are welcome on Binance thanks to the platform’s accommodating lockup periods and low staking requirements (just 0.01 SOL). Furthermore, Binance provides attractive Annual Percentage Yields (APYs), which may change according to market circumstances.

2. Kraken: According to kraken Another reputable cryptocurrency exchange, Kraken places a premium on safety and provides advanced SOL staking capabilities. Despite having a somewhat higher minimum staking amount (0.1 SOL) than Binance, Kraken makes up for it with consistently excellent APYs and an intuitive interface. Kraken gives stakers control over their investment by allowing adjustable lockup periods.

3. Lido Finance: provides an innovative decentralised staking system. Lido will produce a derivative token (stSOL) representing your staked SOL when you deposit your SOL tokens. While your SOL keeps earning staking incentives, you can participate in DeFi protocols. For more advanced staking capabilities, Lido is a solid choice for seasoned investors.

4. Solflare: Staking SOL is made easy with this Solana-native wallet provider. By establishing connections with validators on the Solana network, Solflare facilitates the delegation of SOL and the subsequent earning of incentives. If you’re new to staking and want something easy to use, Solflare is a great option thanks to its instructional materials and intuitive design.

5. Marinade Finance: Staking SOL tokens liquid is available through Marinade Finance, same like on Lido. Users can earn staking rewards and spend their staked SOL in a variety of DeFi applications with the mSOL they receive. For investors looking to make the most of their wealth within the DeFi ecosystem, Marinade is a solid choice.

Important Note: Keep be mind that the APYs provided by these platforms are subject to change depending on factors like validator availability and market conditions.

Also Read: How to Calculate TDS on Cryptocurrency Transactions in 2024- Tips for Indian Investor

Choosing the Right Solana Staking Platform: A Balancing Act

With so many options, how can you choose the best Solana staking platform? Note some points:

- Security: Protect your staked SOL tokens by giving preference to platforms that have strong security measures in place.

- Minimum Staking Requirement: Platforms with low minimum staking amounts are worth considering, particularly if you’re starting with a lesser investment.

- Lockup Periods: If you would like to have some control over your staked SOL, choose a platform that allows you to choose your lockup duration.

- APYs: While enticing, large APYs should not be your primary concern; instead, place your focus on platforms that have a good reputation and a dependable staking infrastructure.

With this information in hand, investors may choose the Solana staking platform that suits their needs in terms of control, risk tolerance, and investment objectives.

Disclaimer: This information is intended for educational purposes only and should not be used as financial advice. There is a significant level of intrinsic volatility in cryptocurrencies, making it a dangerous investment. Never put more money on the line than you can manage to lose; instead, figure out how much you can risk by doing your own study. I hope you like reading “Best 5 Solana Crypto Staking Platforms with Highest ROI in 2024”.