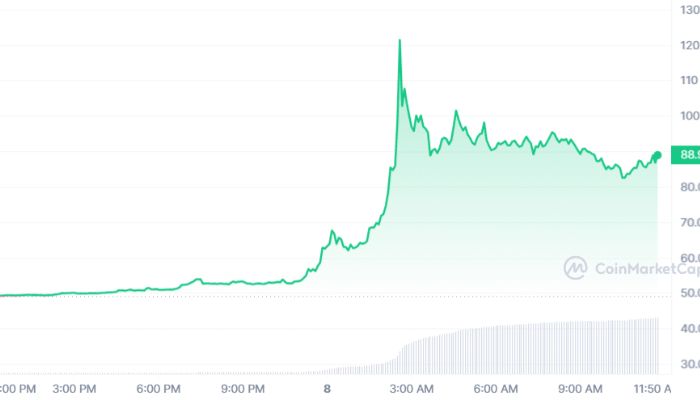

In the United States, FARM, the native token of the Harvest Finance yield farming protocol, was trading at $88—an increase of 80% in the last day—and was thus trending. A staggering 19000% increase brought FARM’s 24-hour trading volume to $218 million as of this writing. The market capitalization of the coin was $40 million as a result of the recent price surge. Get the scoop on “FARM Token Soars 80% in 24 Hours Amidst Trading Frenzy” by reading the article below.

Harvest Finance is a yield farming system that allows users to earn returns by shifting their cash across several defi platforms. Both the Ethereum blockchain and the BNB Smart Chain support trading of this native token, which is known as BEP-20.

Harvest Finance and FARM: A Look Back

According to coinmarketcap, On September 2, 2020, the first day of trading for FARM, the coin hit an all-time high. This was likely due to the fact that there were zero tokens in circulation to begin with, and the few coins that did enter circulation shortly after saw price explosions. A record high of $2,236 was recorded by crypto price aggregator CoinMarketCap for FARM.

Although data providers disagree on the record high, all aggregators notice that FARM’s price decreased to approximately $78 shortly after its launch, towards the conclusion of the “defi summer” of 2020.

As the second wave of the 2021 crypto bubble burst, FARM soared to around $303. On the other hand, FARM went into freefall when the second wave faded towards year’s conclusion. Things took a turn for the worst in October 2020 when Harvest Finance lost $24 million in an attack, sending FARM tumbling 65% in one hour. At least until 2022, the spiral persisted. A low of $33.35 was FARM’s price by May of 2022.

Understanding FARM’s Supply and Tokenomics

Five million coins is the maximum amount that can be programmed into the protocol. After five weeks of introduction, investors decided to cap the supply at 690,420 tokens, with a weekly reduction of 4.45% until August 2024.

Messari, a cryptocurrency price tracker, reports that the supply of FARM is increasing rapidly, expanding from 250,000 in October 2020 to 456,000 in January 2021. Market capitalization peaked at $194 million in February 2021. A full year after the price of a single FARM token had risen to that point.

Harvest Finance Tokenomics:

Following the principles of scarcity, which call for a limited supply. The value of FARM might rise in tandem with rising demand.

A new token is issued by Harvest Finance every week. Seventy percent of this offering goes to liquidity providers and investors that put money into the platform’s asset management plans.

A development fund is established with the remaining 20%, and 10% goes towards continuing protocol development. The engineers who built the protocol are paid from this fund on a periodic basis through the sale of tokens on the cryptocurrency mixer Tornado Cash.

Also Read: Decoding ICOs vs IDOs Comparison-Your Guide to Acquiring Crypto Pre-Listing

Conclusion

Several factors will determine the project’s long-term success, but the recent spike in FARM is encouraging. Critical to the protocol’s success will be its user attraction and constant return generation capabilities. On top of that, if demand increases, the limited supply may conceivably make FARM more valuable.

The DeFi industry is highly competitive, though, so you can’t always trust your outcomes from the past. These considerations, together with extensive study, should precede any investing decisions. The article “FARM Token Soars 80% in 24 Hours Amidst Trading Frenzy” provides a wealth of knowledge, and I hope you gain all of it.

Disclaimer: This post is meant to provide general information and should not be construed as financial advice. High levels of volatility and substantial risk are inherent in the cryptocurrency market. Find out what you’re comfortable with in terms of risk before you make any investment selections.